StatCenter Overall: Difference between revisions

Jump to navigation

Jump to search

| (2 intermediate revisions by the same user not shown) | |||

| Line 90: | Line 90: | ||

=== Ratio stats === | === Ratio stats === | ||

* <u>Sharpe ratio</u> : | * <u>Sharpe ratio</u> : the Sharpe ratio of the trading system. The value is calculated following [https://www.investopedia.com/terms/s/sharperatio.asp this formula]. The risk-free rate value is 0 by default but can be customized in the [[Statistics_Center#Settings|"Settings" menu]] of the statistic center. | ||

* <u>Sortino ratio</u> : | * <u>Sortino ratio</u> : the Sortino ratio of the trading system. The value is calculated following [https://www.investopedia.com/terms/s/sortinoratio.asp this formula]. The risk-free rate value is 0 by default but can be customized in the [[Statistics_Center#Settings|"Settings" menu]] of the statistic center. | ||

* <u>Standard deviation</u> : | * <u>Standard deviation</u> : the standard deviation of the trading system. The value is calculated following [https://www.investopedia.com/terms/s/standarddeviation.asp this formula]. The value in parenthesis is the standard deviation in USD. | ||

* <u>Profit factor</u> : | * <u>Profit factor</u> : the profit factor of the trading system, calculated with the following formula : (sum of winning trades) / (sum of losing trades) in percentage. | ||

* <u>Expectancy</u> : | * <u>Expectancy</u> : the expectancy of the trading system, calculated with the following formula : (winratio * average winning trade) – (lossratio * average losing trade) in USD. The value in parenthesis is the expectancy in pips. | ||

* <u>Z-score</u> : | * <u>Z-score</u> : the Z-score of the trading system. The value is calculated following [https://www.investopedia.com/terms/z/zscore.asp this formula]. | ||

* <u>AHPR</u> : | * <u>AHPR</u> : the Average Holding Period Return of the trading system. The value is the [https://www.investopedia.com/terms/h/holdingperiodreturn-yield.asp HPR] divided by the amount of trades. | ||

* <u>GHPR</u> : | * <u>GHPR</u> : the Geometric Holding Period Return of the trading system. The value is calculated with the following formula : ( BalanceClose / BalanceOpen ) ^ ( 1 / AmountOfTrades ) | ||

* <u>Mar ratio</u> : | * <u>Mar ratio</u> : the Mar ratio of the trading system. The value is calculated following [https://www.investopedia.com/terms/m/mar-ratio.asp this formula]. | ||

* <u>Calmar ratio</u> : | * <u>Calmar ratio</u> : the Calmar ratio of the trading system. The value is calculated following [https://www.investopedia.com/terms/c/calmarratio.asp this formula]. | ||

* <u>CRR ratio</u> : | * <u>CRR ratio</u> : the CRR ratio of the trading system. The value is calculated with the following formula : AbsoluteGrowth / MaxDrawDown. | ||

* <u>Risk of ruin</u> : | * <u>Risk of ruin</u> : the Risk of ruin of the trading system. The value is calculated with [https://www.trading-research.com/en/resources/risk-money-management/48-calculate-your-risk-of-ruin.html this formula]. The risk of ruin probability is set to 80% by default but can be customized in the [[Statistics_Center#Settings|"Settings" menu]] of the statistic center. | ||

* <u>Average W/L ratio</u> : | * <u>Average W/L ratio</u> : the average [https://www.investopedia.com/terms/w/win-loss-ratio.asp winloss ratio] of the trading system. It's calculated with the following formula : AverageWinningTrade / AverageLosingTrade. | ||

* <u>Average R:R</u> : | * <u>Average R:R</u> : the average Risk/Reward ratio of the trading system. It displays the average loss in percentage with the average profit in percentage. | ||

<br> | <br> | ||

Latest revision as of 14:15, 23 March 2022

Summary

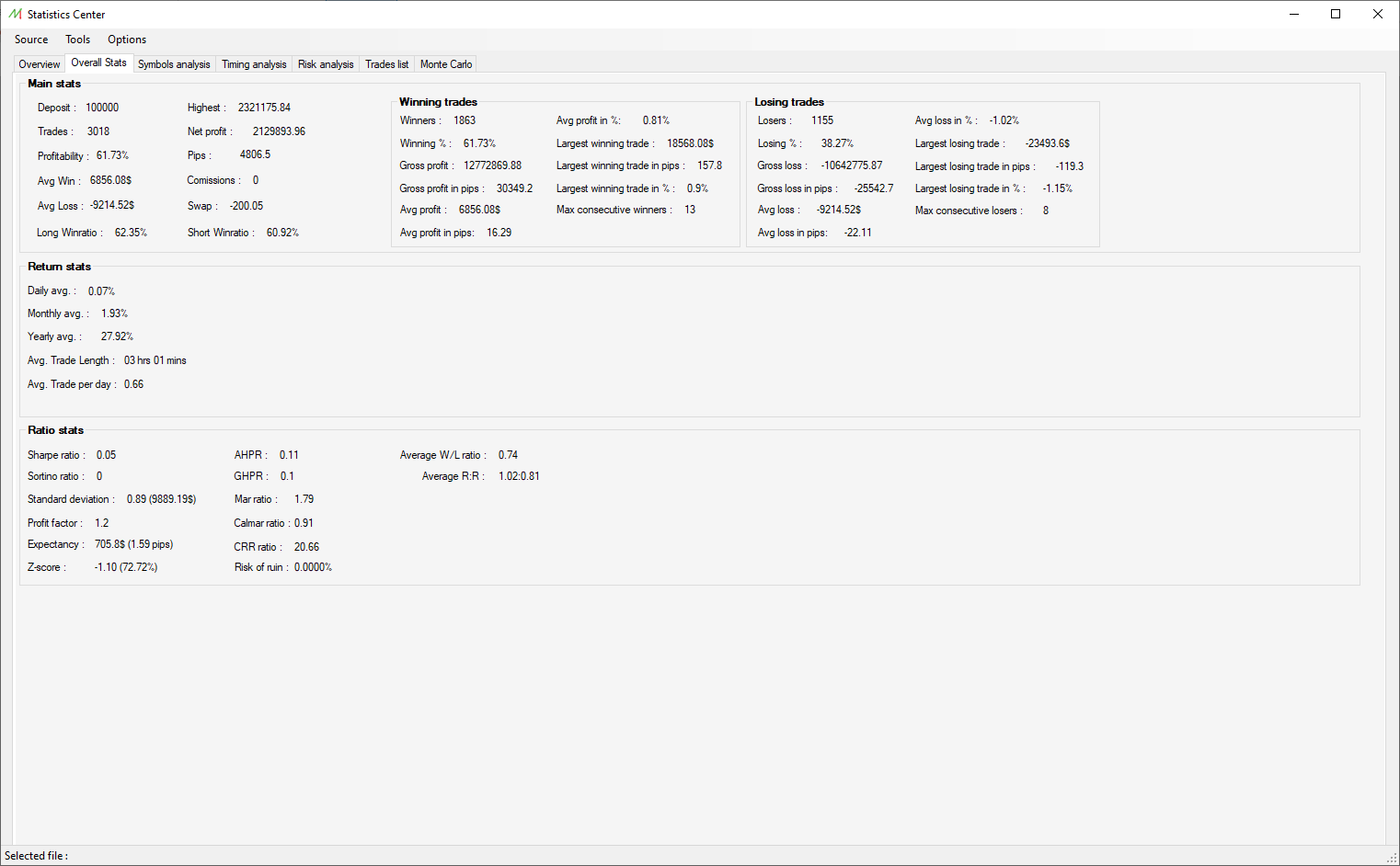

The Overall statistics pane is aimed to provide detailed information to deepen the analysis of the trading system.

Main stats

- Deposit : the initial deposit of the trading account.

- Trades : the number of trades in the statement.

- Profitability : the overall winratio.

- Avg Win : the average winning trade in USD.

- Avg Loss : the average losing trade in USD.

- Highest : the highest value of the equity curve.

- Net profit : the net profit of the statement.

- Pips : the overall quantity of earned pips.

- Commissions : the overall quantity of charged commisions.

- Swap : the overall quantity of charged swaps.

- Long winratio : the winratio for the Buy positions.

- Short winratio : the winratio for the Sell positions.

Winning trades

- Winners : the number of winning trades.

- Winning % : the number of winning trades in percentage.

- Gross profit : the overall gross profit in USD.

- Gross profit in pips : the overall gross profit in pips.

- Avg profit : the average profit per trade in USD.

- Avg profit in pips : the average profit per trade in pips.

- Avg profit in % : the average profit per trade in percentage.

- Largest winning trade : the biggest winning trade in USD.

- Largest winning trade in pips : the biggest winning trade in pips.

- Largest winning trade in % : the biggest winning trade in percentage.

- Max consecutive winners : the maximum number of consecutive winning trades.

Losing trades

- Losers : the number of losing trades.

- Losing % : the number of losing trades in percentage.

- Gross loss : the overall gross loss in USD.

- Gross loss in pips : the overall gross loss in pips.

- Avg loss : the overall gross loss in pips.

- Avg loss in pips : the average loss per trade in pips.

- Avg loss in % : the average loss per trade in percentage.

- Largest losing trade : the biggest losing trade in USD.

- Largest losing trade in pips : the biggest losing trade in pips.

- Largest losing trade in % : the biggest losing trade in percentage.

- Max consecutive losers : the maximum number of consecutive losing trades.

Return stats

- Daily avg. : the average performance on a daily basis.

- Monthly avg. : the average performance on a monthly basis.

- Yearly avg. : the average performance on a yearly basis.

- Avg. Trade Length : the average trade duration.

- Avg. Trade per day : the average number of trades on a daily basis.

Ratio stats

- Sharpe ratio : the Sharpe ratio of the trading system. The value is calculated following this formula. The risk-free rate value is 0 by default but can be customized in the "Settings" menu of the statistic center.

- Sortino ratio : the Sortino ratio of the trading system. The value is calculated following this formula. The risk-free rate value is 0 by default but can be customized in the "Settings" menu of the statistic center.

- Standard deviation : the standard deviation of the trading system. The value is calculated following this formula. The value in parenthesis is the standard deviation in USD.

- Profit factor : the profit factor of the trading system, calculated with the following formula : (sum of winning trades) / (sum of losing trades) in percentage.

- Expectancy : the expectancy of the trading system, calculated with the following formula : (winratio * average winning trade) – (lossratio * average losing trade) in USD. The value in parenthesis is the expectancy in pips.

- Z-score : the Z-score of the trading system. The value is calculated following this formula.

- AHPR : the Average Holding Period Return of the trading system. The value is the HPR divided by the amount of trades.

- GHPR : the Geometric Holding Period Return of the trading system. The value is calculated with the following formula : ( BalanceClose / BalanceOpen ) ^ ( 1 / AmountOfTrades )

- Mar ratio : the Mar ratio of the trading system. The value is calculated following this formula.

- Calmar ratio : the Calmar ratio of the trading system. The value is calculated following this formula.

- CRR ratio : the CRR ratio of the trading system. The value is calculated with the following formula : AbsoluteGrowth / MaxDrawDown.

- Risk of ruin : the Risk of ruin of the trading system. The value is calculated with this formula. The risk of ruin probability is set to 80% by default but can be customized in the "Settings" menu of the statistic center.

- Average W/L ratio : the average winloss ratio of the trading system. It's calculated with the following formula : AverageWinningTrade / AverageLosingTrade.

- Average R:R : the average Risk/Reward ratio of the trading system. It displays the average loss in percentage with the average profit in percentage.